In today's dynamic world, understanding your identity is more essential than ever. Your persona shapes how you relate with the world and influences your success. Unmasking your Identity IQ is about deepening a profound knowledge of who you are, at your core. This journey strengthens you to excel in all aspects of life.

Through introspection, you can uncover your beliefs. These serve as your core compass, shaping your path. By harmonizing your actions with your genuine self, you can realize greater purpose.

Developing your Identity IQ is a ongoing quest. It demands a willingness to discover yourself on a intrinsic level. Embrace the challenge and tap into your full potential.

Boost Your Credit Score: A Step-by-Step Guide

Improving your credit score can seem like a daunting task, but it's absolutely achievable with the right strategies. Initiate by reviewing your credit report for any discrepancies. Challenge any issues you find with the respective credit bureaus. Next, prioritize on paying your payments consistently. This demonstrates dependability to lenders and can significantly impact your score.

Additionally, maintain your credit utilization ratio below 30%. This means using less than 30% of your available credit. Acquire new lines cautiously and avoid applying for too much debt at once. Finally, develop a positive credit history by employing different types of loans. By following these guidelines, you can improve your credit score over time.

Understand Your Financial Health Now

Your credit score plays website a vital role your financial well-being. It indicates your trustworthiness. Checking your credit regularly allows you to make informed decisions. A good credit score provides opportunities for lower monthly payments. Don't wait until you need a loan to realize your credit standing. Take control of your financial future by reviewing your credit report today.

Understanding Your Digital Footprint

In today's interconnected world, it's more important than ever to grasp the impact of your online actions. Every click, post, and communication leaves a trace, forming your unique digital footprint. This footprint can demonstrate a lot about you - your interests, preferences, even your personality traits. While it can be empowering to share knowledge online, it's crucial to be aware of the potential implications.

- Reflect on the platforms you use and the information you share.

- Scrutinize your privacy settings and ensure they align with your comfort level.

- Exercise prudence when sharing personal details.

By taking steps to manage your digital footprint, you can empower a sense of control over your online presence and traverse the digital world with confidence.

A Credit Score's Influence

Building a good credit score isn't just about financial responsibility; it grants doors to a wealth of opportunities. With a strong score, you can qualify for lower interest rates on loans and credit cards, minimizing you money over time. A good credit history also demonstrates your financial trustworthiness to lenders and boosts your chances of approval for mortgages, car loans, and even apartments. Cultivating a healthy credit score is an investment that can serve you well throughout your life.

Protect Your Credit Score: Monitor For Fraud and Identity Theft

In today's digital world, your credit score is more vulnerable than ever to illegal activity. Monitoring your credit report regularly is the best way about identify any unusual activity and safeguard yourself from financial fraud. By reviewing your credit report regularly, you can promptly address any errors before they compound into major difficulties.

- Research using a credit monitoring service that offers regular updates on your history.

- Review your credit report every month for any unfamiliar accounts, purchases, or requests.

- Flag any irregular activity to the credit bureaus and relevant institutions.

Remember, your credit score is a vital part of your financial health. By utilizing proactive steps to monitor it, you can protect your creditworthiness and minimize the risk of fraudulent activity.

Devin Ratray Then & Now!

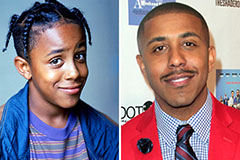

Devin Ratray Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!